Evercore Wealth Management: Introducing the New MD Paula Stumne

Evercore Wealth Management has announced the appointment of Paula Stumne as managing director, wealth, and fiduciary advisor.

UBS Wealth Management: Introducing the New Market Director Aleman

UBS appoints Cy Aleman as Market Director for Oregon, overseeing financial advisors and expanding business operations.

Evercore Exclusive: 3 Wins at the 2024 Investment Banking Awards

Evercore has demonstrated its dynamic support to clients, even in a fragmented and polarized world, earning three prestigious awards at The Banker’s 2024 Investment Banking Awards.

Lazard Asset Management: Introducing the New Managing Director Rosalie Berman

Lazard Asset Management (LAM) proudly announces that Rosalie Berman has joined the team as Managing Director of Business Strategy.

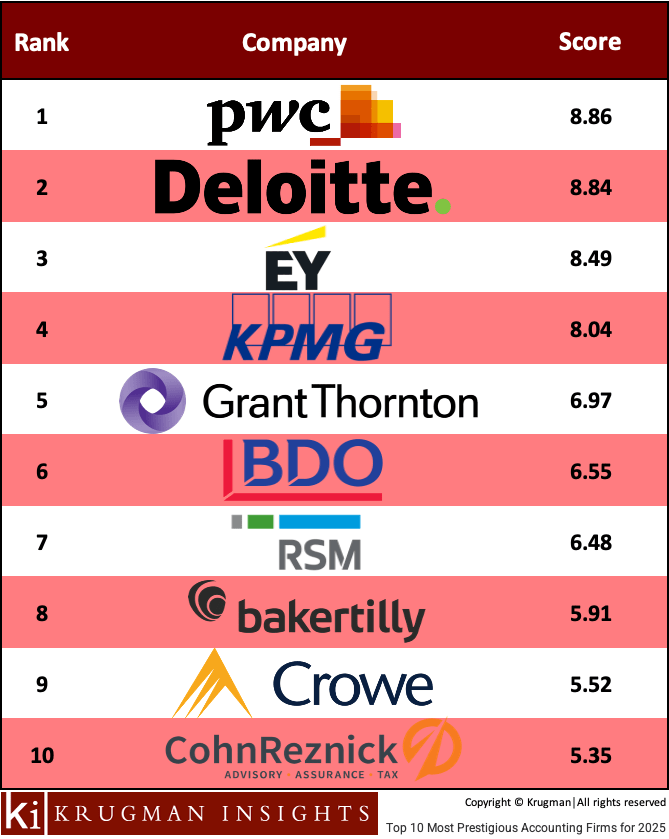

Top 10 Most Prestigious Accounting Firms in the US for 2025

Vault, the leader in data-driven employer rankings and verified employee reviews, has unveiled its 2025 rankings of the Most Prestigious Accounting Firms in the U.S.

Barclays Advisory Exclusive: The Property Franchise Group Acquires Two Real Estate Firms for £20m

Barclays has advised in The Property Franchise Group’s acquisition of The Guild of Property Professionals and Fine & Country for £20 million.

Jefferies, Goldman Sachs: Financial Advisory on $630m Biotechnology Deal Explained

Jefferies and Goldman Sachs played crucial roles in the recent $630 million acquisition of Surmodics, Inc. by private equity firm GTCR.

Scotiabank Exclusive: Wealth-Management Revenue Increases Beating Q2 Estimates

Scotiabank has reported second-quarter earnings that exceeded analysts’ forecasts despite a challenging global economic backdrop.

Alantra Exclusive: Sell-Side Advisory and Debt Financing for ITAL Express

Alantra has been instrumental in advising ITAL Express shareholders on selling the company to Naxicap Partners, with management reinvesting in the business.

Bryan, Garnier & Co Promotes 4 To Strengthen European Presence

Bryan, Garnier & Co has announced key promotions to bolster its European presence at a crucial time for the financial sector, which is facing challenges like market volatility, inflation, and regulatory changes in the EU. Over the past year, the firm has successfully completed more than 60 transactions across sectors such as Software & Fintech, […]

Continue with Facebook Continue with Google