In a move to bolster its position as a global financial digital platform and enterprise solutions provider, FactSet has made a strategic leap forward with the acquisition of idaciti, Inc.

The announcement, made on July 12, 2023, marks a significant milestone in FactSet’s multi-year investment program to digitally transform its content collection infrastructure.

This acquisition not only strengthens FactSet’s data structuring and collection capabilities but also accelerates the delivery of critical data sets, laying the foundation for next-generation workflows.

Deal Summary and timeline:

According to S&P Capital IQ, FactSet has successfully attained 100% equity ownership of Idaciti, Inc., a pioneering company specialising in data structuring and collection technology.

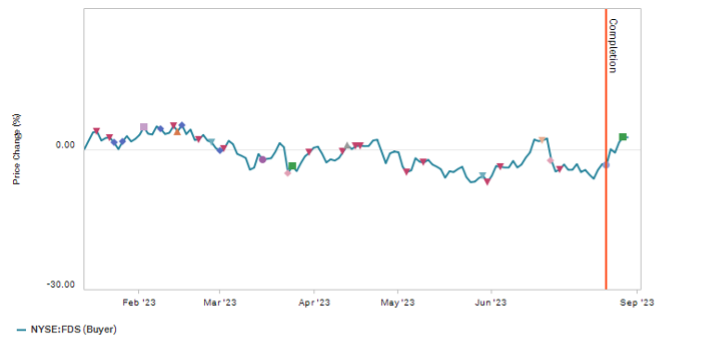

While the specific details of the deal, including the consideration and amount, remain undisclosed, the completion of this acquisition marks a significant milestone for FactSet in its pursuit of expanding its financial data empire, below is the deal timeline:

Figure 1-Deal Timeline

RELATED Citigroup significantly cuts lending to buyout firms

Acquirer and target company profiles:

Headquartered in Norwalk, Connecticut, FactSet has earned a reputation as a leading provider of financial data and technology solutions.

The acquisition of idaciti, an innovative company specialising in data structuring and collection technology, adds a powerful dimension to FactSet’s offerings.

Founded in 2015, idaciti has made waves in the industry with its “taxonomy-first” approach, revolutionising how information from company disclosures, regulatory filings, and proprietary document repositories is structured.

Through machine learning-assisted technology, idaciti captures and standardises data at an exceptional level of granularity, quality, and speed.

The platform employs a modern collection workflow that seamlessly connects data discovery, normalisation, and quality assurance in a single, iterative process.

With this advanced technology in its arsenal, FactSet is poised to elevate the granularity of data collected, particularly in the Deep Sector and sustainability domains, in response to the rapidly increasing client demand and opportunities for differentiation in these areas.

Strategic Benefits for FactSet:

The deal provides various strategic benefits for FactSet, some of which are explained below.

-

- Enhanced Data Collection Infrastructure: FactSet’s acquisition of idaciti brings together FactSet’s global financial digital platform and enterprise solutions with Idaciti’s innovative data structuring and collection technology. This synergy allows FactSet to expand and digitally transform its content collection infrastructure, enabling faster and more efficient data gathering processes.

-

- Accelerated Time-to-Market: By integrating Idaciti’s machine learning-assisted technology and modern collection workflow, FactSet can accelerate the delivery of critical data sets. This capability enables faster time-to-market for next-generation workflows, empowering FactSet to meet the increasing demand for timely and comprehensive data from clients.

-

- Deep Sector and Sustainability Coverage: FactSet aims to enhance its coverage and depth of proprietary content, particularly in Deep Sector and sustainability areas, where strong client demand exists. With Idaciti’s expertise in capturing and standardising data at an exceptional level of granularity, FactSet can bolster its offerings in these key areas.

-

- Granularity and Quality of Data: Idaciti’s “taxonomy-first” approach to structuring information and machine learning-assisted technology allows for the capture and standardisation of data at a high level of granularity and quality. This will contribute to improving the overall data quality and accuracy within FactSet’s offerings.

RELATED OMV and ADNOC Discussing a Potential Merger for Their Chemical Divisions

Deal Rational and Conclusion:

The acquisition of idaciti by FactSet is a strategic move that not only enhances the company’s data structuring capabilities but also bolsters its position in the market relative to competitors like S&P Capital IQ, Definitive, Bloomberg, and Capital IQ.

Currently holding a 6.2% share of the market, FactSet aims to expand its market presence by providing clients with easy-to-draw insights from extensive data insights.

In an industry where major players like Bloomberg dominate the market, FactSet seeks to differentiate itself by offering comprehensive and user-friendly data solutions.

The addition of Idaciti’s Software as a Service (SaaS) platform, with its powerful ESG Accelerator, aligns perfectly with FactSet’s mission.

The ESG Accelerator empowers FactSet to provide access to over 800 normalised and traceable ESG data points, filings, and reports in real-time.

This capability gives FactSet a competitive edge in meeting the growing demand for ESG-related insights from clients.

Moreover, the platform’s automation tools streamline ESG research and data collection, allowing FactSet to deliver clean, structured, and tailored data to researchers, analysts, and data scientists.

With the integration of Idaciti’s technology, FactSet can create a connected inventory of content, enabling data traceability back to its source documents. This feature reinforces FactSet’s commitment to providing reliable and trustworthy data to clients.

By embracing Idaciti’s SaaS and ESG Accelerator, FactSet is well-positioned to expand its market share and become a leading provider of financial data and insights.

The acquisition not only strengthens FactSet’s data structuring capabilities but also reaffirms its dedication to innovation and customer-centric solutions.

As FactSet continues to leverage Idaciti’s advanced technologies, it is poised to drive mutual growth and value creation for both FactSet and its clients.

To get in contact with feedback on this article please email us at publishing@krugmaninsights.com

Continue with Facebook Continue with Google