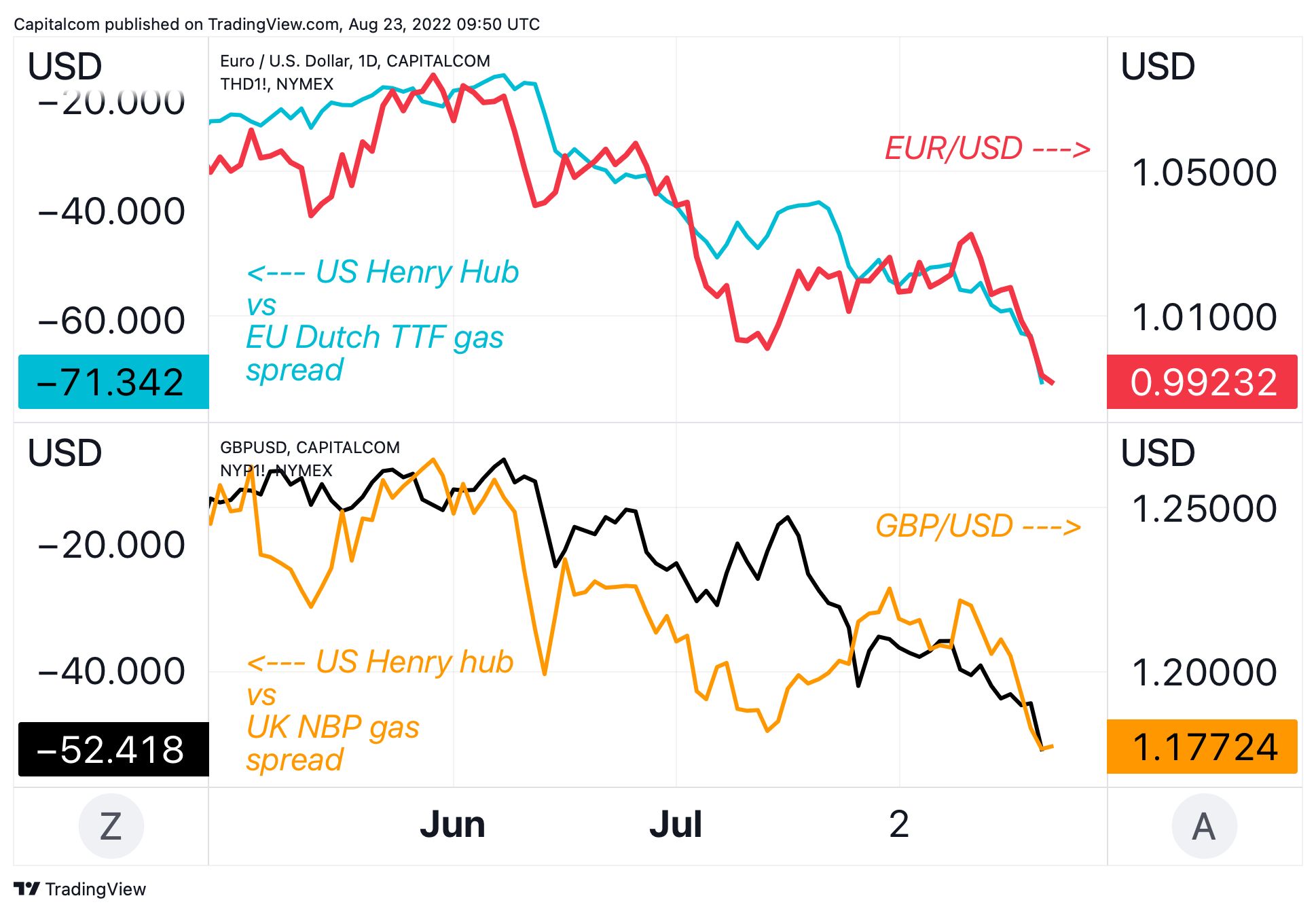

Emergency rate hikes by the ECB and BoE wouldn’t be detached with the current situation, in order to prevent further depreciation of the euro and the pound.

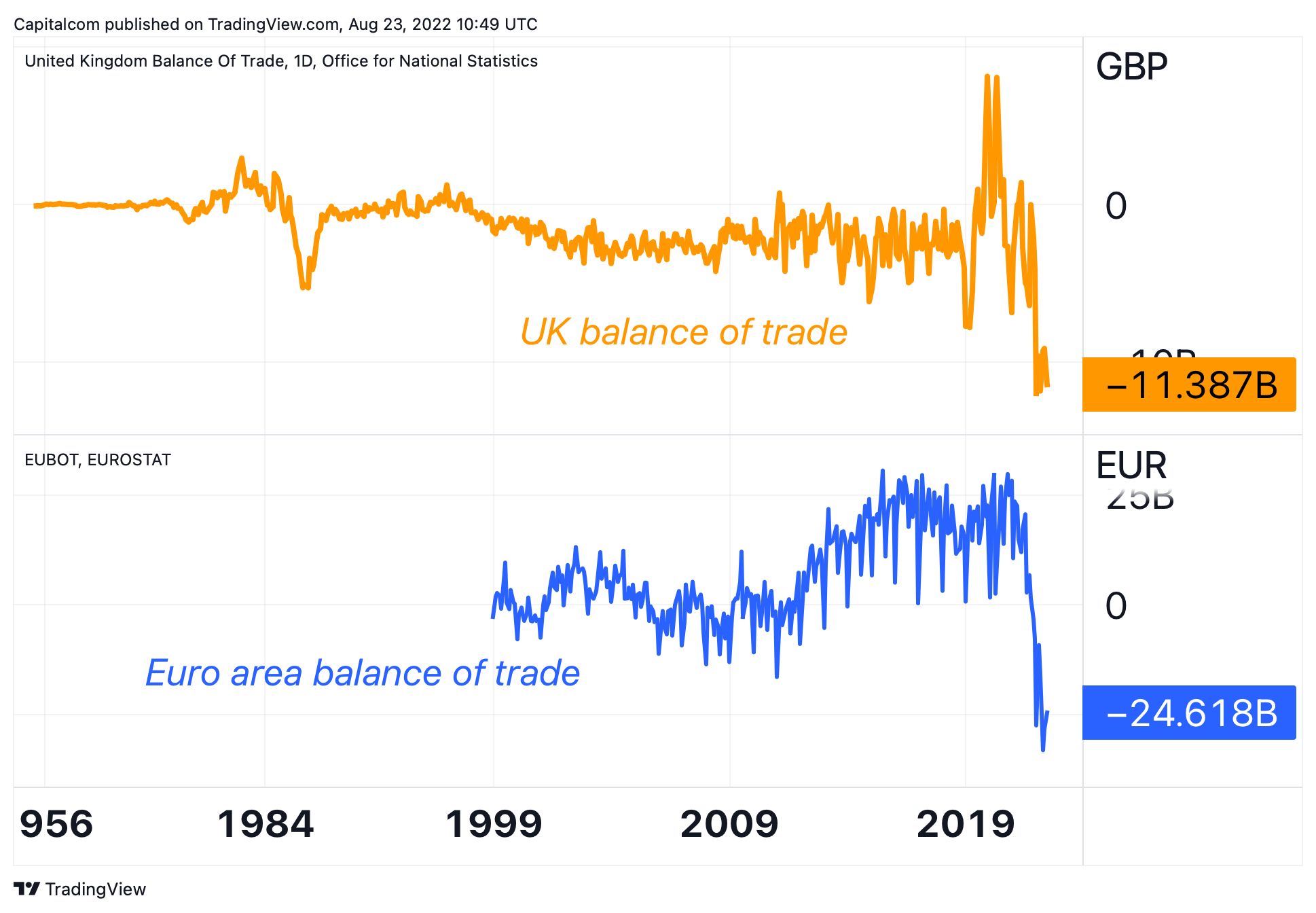

The need to import expensive LNG from abroad, to compensate for Russia’s gas shortfall, is disrupting UK and EU trade flows, both of which are showing record-high trade deficits.

European Dutch TTF and UK gas (NBP) prices are currently trading 8 and 6 times higher than US natural gas prices, respectively, thus creating a substantial competitive disadvantage for European companies.

Trade flows are difficult to reverse anytime soon given the current geopolitical environment, but financial speculative flows could be curbed through higher interest rates.

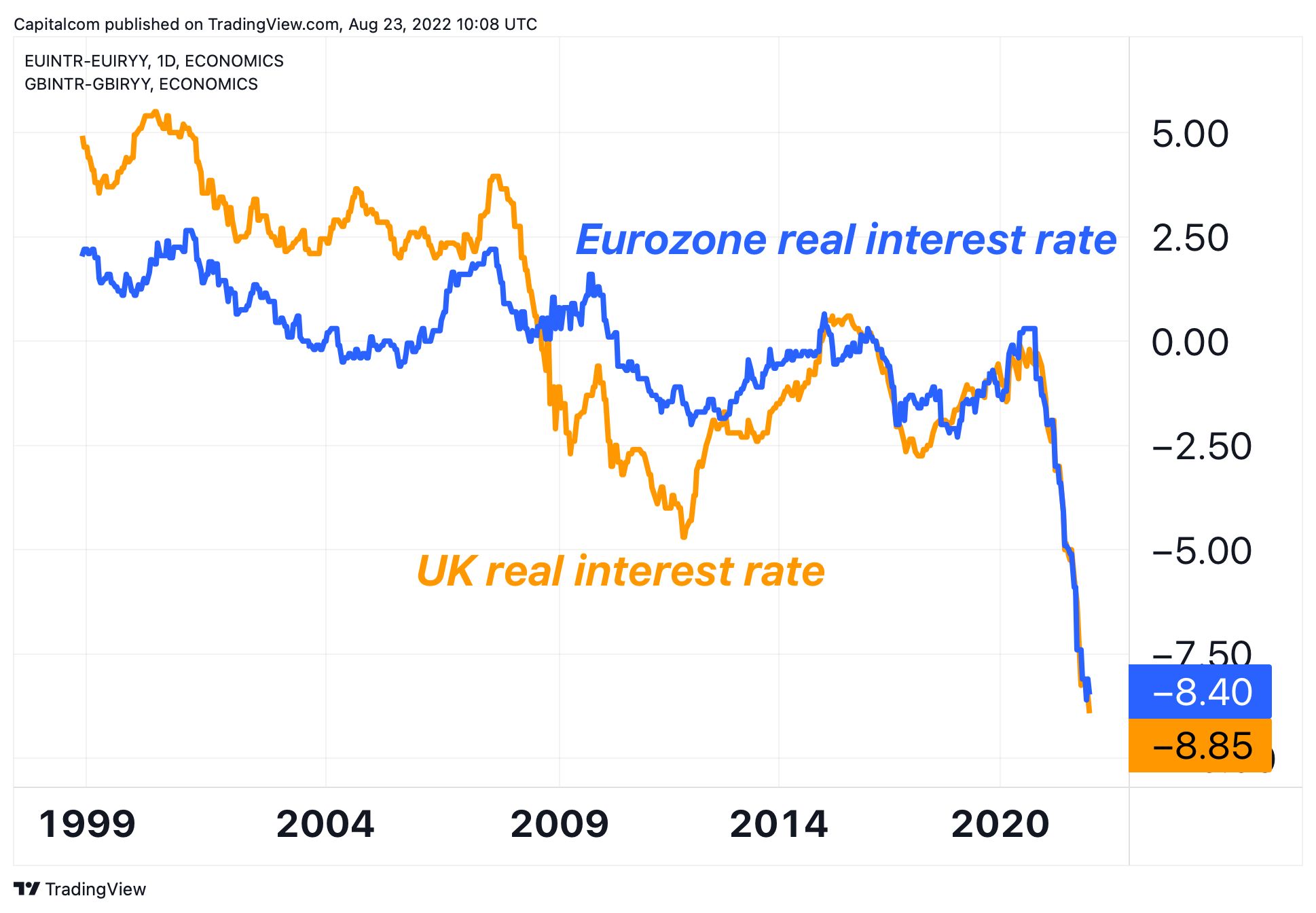

However, real policy rates in deep negative territory (-8.4% for the Eurozone and -8.8% for the UK) are not exactly good calling cards for the euro and the pound to lure in investors.

With UK and Eurozone inflation predicted to stay well above double digits in the coming months, the ECB and BoE must raise interest rates aggressively to stop currency depreciation and avoid a de-anchoring of inflation expectations.

Failure to act now may have far-reaching consequences in the future.

Analyst: Piero Cingari

Continue with Facebook Continue with Google