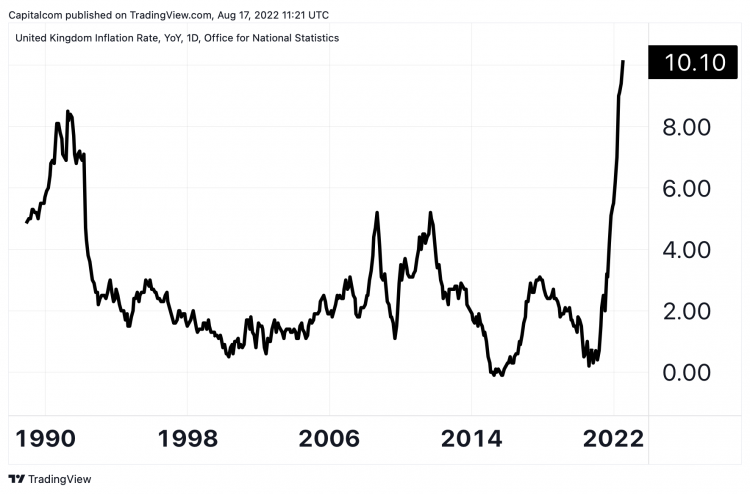

For the first time in over 40 years, the UK inflation rate in July 2022 topped the double-digit mark (10.1% year on year), while core inflation, which excludes energy and food items, rose by 6.2% in the year, marking the highest increase since the series began in 1997.

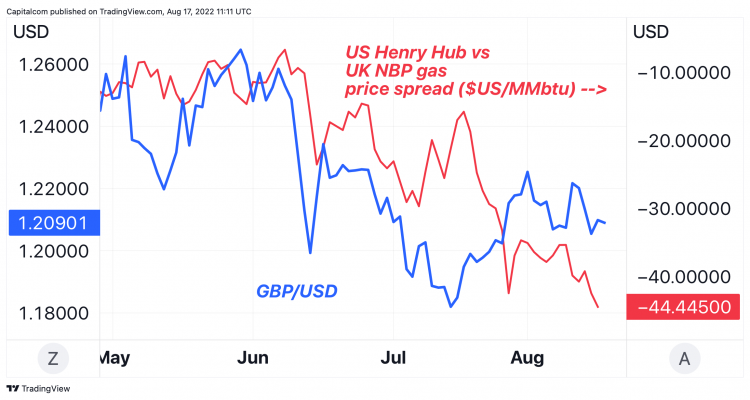

The pound has lost 12% against the dollar (GBP/USD) in the past year due to a widening interest-rate gap between the Federal Reserve and the Bank of England (BoE) and worsening macro fundamentals in the UK. The consumer inflation shock in the UK and Europe is backed by stubbornly high production costs, especially wholesale oil and gas. The UK producer price index is 17.1% higher than a year ago, the highest rate since July 1980.

With a recession looming over the UK, will the Bank of England have enough leeway to raise interest rates and support the pound? Or will the energy crisis and gas price disparity between the United Kingdom and the United States continue to boost the US dollar?

GBP/USD chart to watch: US natural gas trades at steep discount to UK gas, weighing on the pound

GBP/USD fundamental analysis: No sign of easing downside pressure

Europe is experiencing its worst energy crisis in history, which is materially worsening the UK’s economic and trade fundamentals.

Inflation in the UK has risen above the danger zone, according to all available indicators. The CPI index is up 10.1% year on year, the core CPI is up 6.2%, the PPI is up 17.1%, and Yougov/Citigroup public inflation expectations are at their highest level ever (6%).

Rising inflationary pressures cloud the growth picture for the United Kingdom.

Real wages (adjusted for inflation) are 5% lower than a year ago, the lowest level since the financial crisis of 2009, which will likely have a negative impact on future consumption. According to the Gfk Group survey, consumer confidence remained severely depressed at all-time lows (-41) in July. Falling real wages and low consumer confidence have historically been linked to impending economic downturns in the UK.

In its July meeting, the BoE predicted a protracted economic downturn beginning in the fourth quarter of this year. This will likely hurt the pound, especially if the US avoids a major recession.

Analyst: Piero Cingari

Continue with Facebook Continue with Google