If you are watching the markets, LinkedIn or Twitter closely, you would’ve most definitely have heard Credit Suisse mentioned a few too many times. So, what is all this fuss about? And what has happened to the $12.2 Billion company?

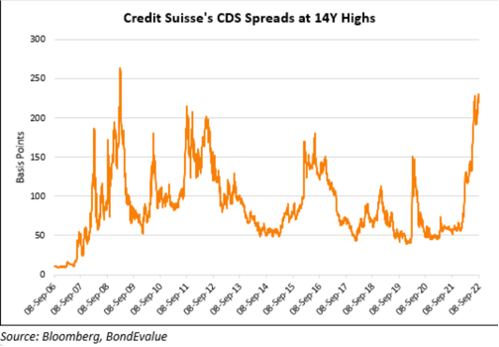

We can see from the graph above, the Credit Suisse CDS price has surged from 250 to 316 over the weekend (28/09/2022-31/09/2022). What is CDS? Maybe you will be familiar with it if you were in the industry in 2008 or you happened to watch The Big Short! But if not, please allow me to give you a brief introduction to credit default swap (CDS).

What is a CDS?

CDS is essentially an insurance against debt being defaulted. Let us look at some relationship between lender, borrower and the seller of the credit default swap. For the purpose of demonstration, imagine A lend B money, and A buys CDS from C.

Essentially, there are two situations that could occur:

1) No event.

If B pays back money on time to A. Then C does not need to take action. A received the money from B, however they must pay a monthly premium to C, which is their insurance in case B cannot pay.

2) Credit event.

If B cannot pay back to A, the CDS will start to function. This situation is called a credit event, it includes bankruptcy, failure to pay and in some countries, involuntary reconstruction.

Party C will cover the money party B has defaulted on, due to the CDS party C and A agreed on.

Therefore, party A shifted the risk of the debt defaulting by paying a little price (maybe not in Credit Suisse’s case) to C, for bearing the risk. As always, CDS can be traded since it is a derivative, so the price of the CDS varies. It follows the law of economics, price changes following supply and demand.

So why does the sky rocketed CDS in Credit Suisse matter?

Higher CDS price means higher demand, means there are more loan to cover in the market, onestep further, the people who wants CDS are pricing in higher risk of people defaulting, which is true seeing the current market: rising interest rate and deteriorating credit quality.

Then came the army of twitter, which saw a pattern of CDS spiking which was instantly linked to the 2008 financial crisis because, without really thinking.

People like Spencer Jakab of the Wall Street Journal’s Head on the Street column, and various pundits have been putting out Tweets like those below,

“I trust that you are not confusing our day-to-day stock price performance with the strong capital base and liquidity position of the bank.” Credit Suisse CEO Sept 30, 2022.

“Our capital position at the moment is strong.” Lehman Brothers CFO Sept 8, 2008.

The fundamental difference between Lehman in 2008 and Credit Suisse in 2022 is expressed in another Twitter comment observing that Credit Suisse’s detractors, “are confusing a US investment bank whose CEO had no friends among the authorities with a Swiss banking behemoth plugged into a country that prides itself on the safety of its institutions… and its banks.”

At the time of writing this article, Credit Suisse’s stock price already bounced back 16% from the lowest point. Where will this lead to? For those really interested in this story, feel free to research Credit Suisse suppressing their stock price before raising more capital through issuing equity.

Analyst: Hanxian Liang

Continue with Facebook Continue with Google