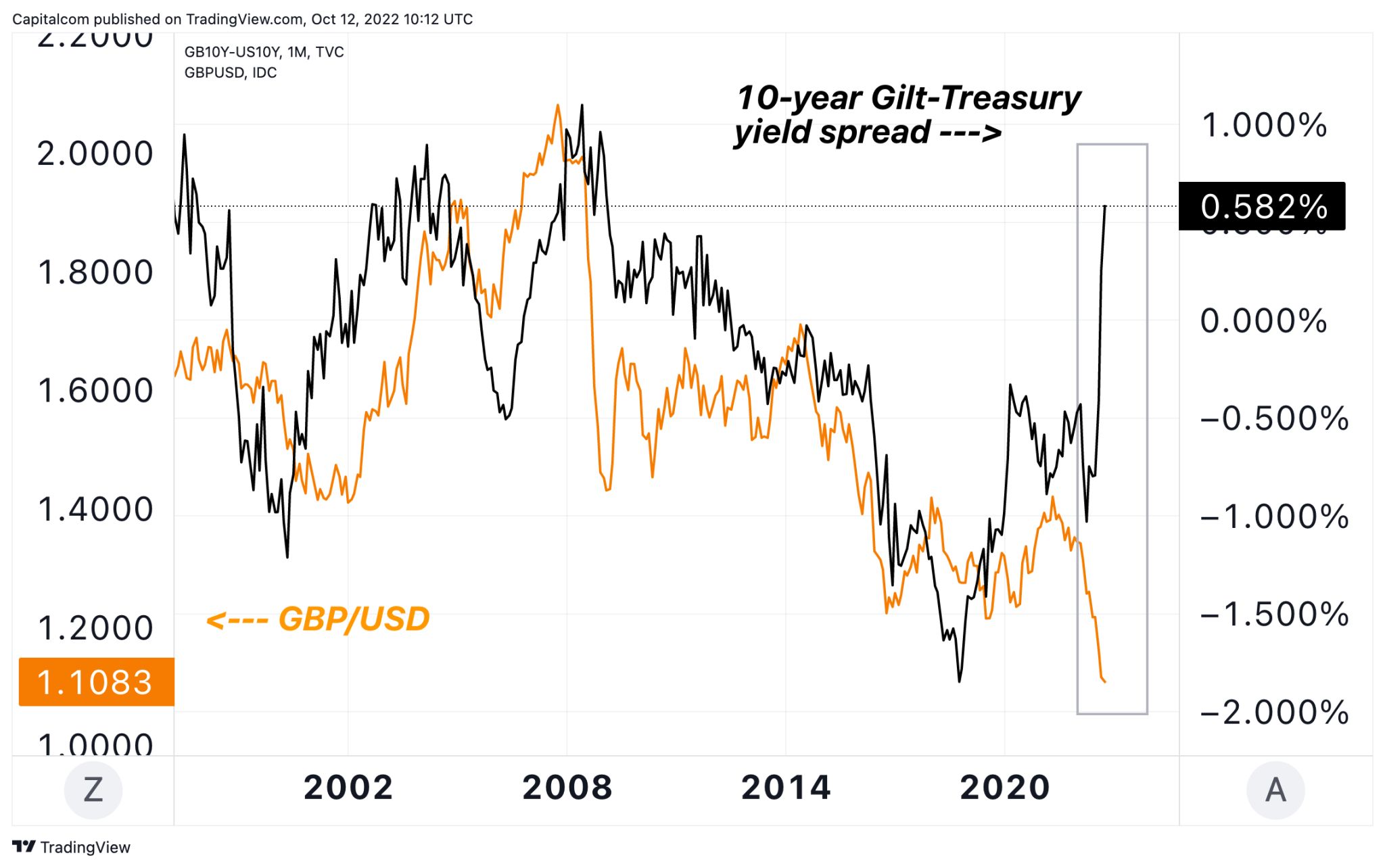

The relationship between the British pound and Gilt-Treasury yield spreads has never been so far apart.

Under normal market conditions, the exchange rate and bond yield spreads should move together. Currently, we are observing non-linear effects in UK financial assets.

Under normal market conditions, the exchange rate and bond yield spreads should move together. Currently, we are observing non-linear effects in UK financial assets.

Gilt yields have gone through the roof and the pound is plummeting because investors are now worried about how the UK’s fiscal policy and monetary policy work together.

The Bank of England appears to be faced with the following trade-off: either fighting inflation with all available means, which runs the risk of triggering a major financial crisis, or tolerating structural and higher-for-longer inflation, which runs the risk of losing the monetary anchor and allowing the fiscal policy to dominate.

The EU and ECB should take note as macro conditions are not that dissimilar to those in the UK.

Central bankers have it rough right now.

Analyst: Piero Cingari

Continue with Facebook Continue with Google